Mutual Funds are investment bags that pool money from number of investors to invest in a diversified portfolio of different assets which are managed by a professional fund manager. By pooling resources and leveraging professional expertise, mutual funds aim to provide investors with the potential for wealth creation, diversification, and convenience in achieving their financial goals.

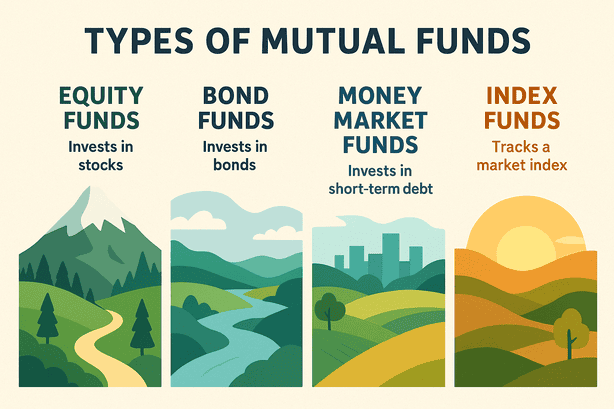

With its own investment objective and strategy, here are several types of mutual funds.

Types of Mutual Funds :

Classification based on organizational structure

Open – Ended Funds:

They issue and redeem shares based on investor demand. The number of shares in an open ended mutual fund can fluctuate based on inflow and outflow of investor money. These are often suited for retail investors due to their liquidity and accessibility and are most common type to see in mutual funds.

Close – Ended Funds:

Close End funds have a fixed number of shares issued through an IPO.

These types of Funds do not issue or redeem shares on investor demand; instead, investors buy and sell shares from other investors on the secondary market.

Interval Schemes:

Interval funds exhibit attributes that combine features of both open-end and closed-end funds. These funds issue shares at predetermined intervals, usually quarterly, through a tender offer to existing shareholders.

Investors can buy shares from the fund during the specified tender offer period. Such funds typically invest in illiquid assets or alternative investments, such as real estate or private equity, which require a longer holding period.

Classification based on asset classes they primarily invest in

Equity Funds / Stock Funds:

Invest predominantly in stocks or equity- related securities. They aim to provide capital appreciation in the long term. They provide high returns while facing a high risk.

These funds can be additionally classified based on market capitalization

Large-Cap Funds: These funds primarily invest in large, well-established companies i.e., the companies that are ranked in the first 100 in the list of stocks prepared by AMFI depending on market capitalization.

Mid-cap Funds: These funds invest at least 65% of portfolio in medium-sized companies with moderate market capitalization, i.e. the companies with market capitalizations ranging from the 101st to the 250th position in terms of ranking.

Small-cap Funds: These funds focus on investing at least 65% in small-sized companies with relatively lower market capitalization. i.e. the companies that are ranked 251st and above based on their market capitalization. They aim to capture significant growth opportunities, but they can be more volatile.

Multi-Cap Funds: These funds invest across companies of various market capitalizations, offering diversification across the large-cap, mid-cap, small-cap stocks.

ELSS: ELSS funds primarily invest in equity and equity-related instruments. They are specifically designed to provide tax benefits under Section 80C of the Income Tax Act in India. Investors have option to claim tax deductions of up to Rs. 1.5 lakh under this section. ELSS funds have a lock-in period of three years, which means investors cannot redeem their investments before the completion of this period. These funds provide the opportunity to generate higher returns compared to traditional tax-saving investment options

International funds: These funds primarily invest in securities of companies listed in foreign markets, providing investors with exposure to global equities or other assets outside their domestic market.

Debt Mutual funds / Fixed Income Funds:

Invest primarily in fixed-income securities such as government bonds, corporate bonds, treasury bills, and money market instruments. Debt funds aim to provide stable income and capital preservation as they are not affected by market volatility. They can be further classified based on the duration of the underlying securities:

Liquid Funds / Ultra short term debt funds: Liquid funds invest in short-term money market instruments with a maturity of up to 91 days.

These funds are designed for investors seeking a safe haven for their surplus cash or looking for an alternative to traditional savings accounts with the potential for slightly higher returns.

Overnight Funds: type of debt mutual funds that invest in very short-term debt instruments with a maturity period of one day. These funds offer stability and low risk; the returns may be relatively lower compared to longer-duration debt funds. Corporates often utilize overnight debt funds as a means to temporarily allocate their funds.

Money Market Funds: These funds provide a conservative approach to short-term investing by focusing on low-risk, highly liquid debt instruments such as Treasury Bills, commercial papers, certificates of deposit, and other highly liquid instruments which are short term with maturity periods of less than one year. These funds aim to maintain a stable net asset value (NAV) of typically ₹1 per unit and provide investors with a secure place to park their cash while earning a modest income.

Banking and PSU Funds: These funds primarily invest in debt securities issued by banks and public sector enterprises. They aim to provide investors with a combination of safety, liquidity, and relatively higher returns compared to traditional fixed deposits or savings accounts. Banking and PSU funds are suitable for investors with a medium to long-term investment horizon. While they offer liquidity

Gilt Funds / Government security funds: Gilt funds predominantly invest in government securities, such as treasury bills, government bonds, and other fixed-income instruments issued by the central and state governments. These are generally considered to be the safest form of investment, as they have a low risk of default.

Hybrid Funds / Balanced Funds:

These funds allocate their investments across multiple asset classes, primarily equity and debt. They aim to provide a balanced approach by combining growth potential from equities and stability from debt instruments.

Here are some common types of hybrid funds based on their allocation to equity and debt.

Conservative Hybrid Funds / Debt oriented Hybrid funds: Allocate a significant portion of their portfolio to debt instruments such as government securities, corporate bonds, and money market instruments. The equity allocation is relatively lower, typically ranging from 10% to 25%. Aim to provide stable income with a conservative approach to risk.

Balanced Hybrid Funds: Balanced hybrid funds maintain a balanced allocation between equity and debt instruments, typically with an equity allocation of around 40% to 60%. They are suitable for investors with a moderate risk appetite and a longer investment horizon.

Aggressive Hybrid Funds: These funds have a higher allocation to equities, usually ranging from 65% to 80%. These funds aim to provide investors with relatively higher growth potential by having a larger exposure to equities, while still offering some downside protection through the debt component.

Dynamic Asset Allocation Funds: Dynamic asset allocation funds, also known as asset allocation funds or balanced advantage funds, have the flexibility to dynamically allocate their assets between equity and debt based on market conditions. These funds aim to deliver stable returns across different market cycles.

Overall, mutual funds provide a convenient and professionally managed way for individuals to invest in a diversified portfolio of securities, offering the potential for capital appreciation or income generation based on their investment objectives. Consulting with a financial planner can provide valuable guidance in selecting appropriate mutual funds based on individual needs.

Not to forget, Mutual fund investments are subject to market risk, read all scheme related documents carefully.