As a Non-Resident Indian (NRI), you may frequently wonder how to transfer your hard-earned money from India to your place of residency. This technique, known as NRI repatriation, allows you to transfer funds legally while adhering to FEMA standards and RBI norms.

Understanding cash repatriation is critical to avoiding tax problems and regulatory delays, whether it’s income earned in India, property sale profits, or inherited assets.

This guide walks NRIs through the procedure, including eligibility laws, limits, and advice for a seamless Repatriation of Funds by NRIs.

What Is Repatriation of Funds?

Repatriation is simply the transfer of funds from India to a foreign bank account in your resident country. It entails changing Indian rupees (INR) into the desired foreign currency and sending it abroad in accordance with the Foreign Exchange Management Act (FEMA).

Funds that can be repatriated include:

· Proceeds from NRI investments (mutual funds, stocks, FDs)

· Rental income or pension earned in India

· Sale proceeds of property/assets in India

· Inherited or gifted money

Repatriation ensures your funds are transferred legally, with proper tax compliance and documentation.

NRI Account Types & Repatriation Eligibility

To understand how repatriation works, you must first grasp the various NRI bank accounts in India, as well as the restrictions that govern money transfers outside.

1. NRE Account (Non-Resident External)

An NRE account is meant for parking your foreign income in India. The biggest advantage is that funds in an NRE account are fully and freely repatriable. Both the principal and the interest earned can be sent abroad without any restrictions. Moreover, the interest earned on this account is tax-free in India, making it ideal for NRIs planning to move money back to their resident country.

2. FCNR Account (Foreign Currency Non-Resident)

The FCNR account is a fixed deposit account maintained in a foreign currency. It protects you from currency fluctuations because deposits remain in the same currency. Like the NRE account, funds in the FCNR account are completely repatriable. You can transfer both the deposit and interest income abroad at any time without restrictions, and the interest earned is exempt from Indian taxes.

3. NRO Account (Non-Resident Ordinary)

An NRO account is used to manage income earned in India, such as rent, dividends, pensions, or proceeds from the sale of property. Repatriation from an NRO account is restricted compared to NRE and FCNR accounts. You can remit up to USD 1 million per financial year (April to March) after paying applicable taxes in India. The interest earned in an NRO account is subject to TDS (Tax Deducted at Source) as per Indian tax laws.

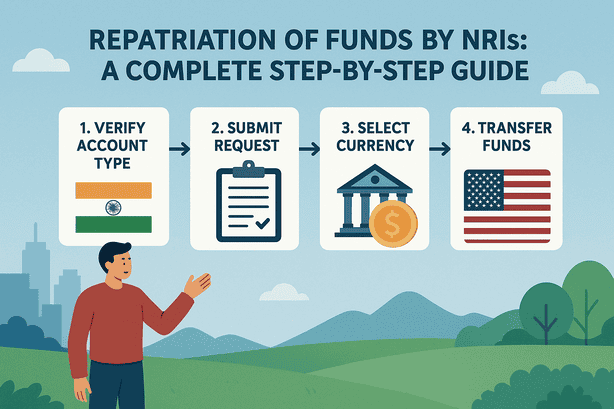

Step-by-Step Process to Repatriation of Funds

1. Choose the Right Account

NRE/FCNR Account: Best for repatriating foreign income or deposits. Funds are fully repatriable with no upper limit.

NRO Account: Used for Indian-sourced income like rent, dividends, or property sale proceeds. Repatriation is subject to a USD 1 million annual limit (after taxes).

2. Make Sure You Follow the Tax Rules

- Pay applicable taxes on income to be repatriated (important for NRO accounts).

- Get a CA certificate (Form 15CB) that says you have paid your taxes.

- Before sending money, file Form 15CA online as a self-declaration.

3. Gather Required Documents

For NRE/FCNR Accounts:

- Repatriation request form

- Passport and valid visa/residence proof

- Bank statements for the account

- FEMA declaration (Form A2)

For NRO Accounts:

- Repatriation request form

- Passport, visa/residence proof, and PAN card

- Form 15CA and Form 15CB

- Form A2 (foreign exchange declaration)

- Proof of source of funds (e.g., sale deed, inheritance papers)

4. Submit Your Request

Provide all documents to your Indian bank (authorised dealer).

The bank will verify, process the application, and initiate the transfer to your overseas account.

5. Track and Confirm

Your bank will give a transaction reference and confirmation once funds are remitted.

Keep copies of all documents and acknowledgements for future reference and compliance.

Pro Tips for Hassle-Free Repatriation

1. Start tax paperwork early, especially for large NRO repatriations

Tax compliance is one of the biggest hurdles in repatriation. Begin collecting documents and filing Forms 15CA and 15CB well in advance to avoid delays. For high-value transfers, early preparation helps you address any tax queries or additional requirements from your bank or the Income Tax Department.

2. Track foreign exchange rates to maximize remittance value

Since repatriation involves converting INR to your resident country’s currency, timing your transfer around favourable forex rates can make a significant difference. Even a small shift in exchange rates can impact large remittances, so monitor the market and use tools like rate alerts.

3. Consult a tax advisor or financial planner for complex transactions

If you’re repatriating proceeds from property sales, inheritance, or multiple income sources, professional advice is invaluable. Experts like us can help you navigate FEMA rules, avoid double taxation, and ensure compliance with both Indian and foreign tax laws.

4. Choose banks with digital services for faster processing of Forms 15CA and 15CB

Many banks now have online facilities for filing repatriation applications and papers. Choosing such banks expedites verification and eliminates the inconvenience of physical visits, especially if you are handling the procedure from abroad.

Final Thoughts

Repatriating funds from India does not have to be difficult. NRIs can transfer cash abroad with convenience and confidence by understanding the account kinds, being tax-compliant, and completing the necessary papers.

Planning ahead of time guarantees that your rental income, investment returns, or property sale revenues flow smoothly across borders.

Always seek professional guidance for major transactions or complex issues in order to avoid regulatory obstacles.

Frequently Asked Questions (FAQs)

Q1: Can I return funds from India without paying taxes?

Yes, if the funds are in an NRE or FCNR account, both principal and interest are tax-free. Taxes must be paid on NRO accounts before repatriation may occur.

Q2: What is the maximum amount that can be repatriated from India?

There is no limit on funds from NRE/FCNR accounts. You can repatriate up to USD 1 million after taxes from an NRO account each fiscal year.

Q3: How long does the repatriation process take?

It typically takes 7-15 business days, depending on the bank and documents. Delays may arise if forms or tax compliance are not completed.

Q4: Can I repatriate funds from the sale of inherited property?

Yes. Prior to repatriation, you must produce proof of inheritance (such as a will or succession certificate) and pay any appropriate taxes.

Q5: Do I require RBI approval to repatriate funds?

RBI permission is only necessary if your NRO repatriation exceeds USD 1 million per year or includes sale profits from more than two properties.