Understanding the 7 Smart Ways to Grow Wealth Even If You Earn Less can transform your financial situation.When people hear the term wealth building, they often associate it with high salaries, luxurious lifestyles, or large inheritances. But the truth is, you don’t need to earn a lot to build wealth; you just need a system, discipline, and a long-term mindset.

If you’re earning a modest income today, don’t let that discourage you. Many self-made millionaires started out with very little. What made the difference was their ability to live below their means, save consistently, and invest smartly.

Here’s a comprehensive guide on how to build wealth with a low income, grounded in practical strategies and real-world examples.

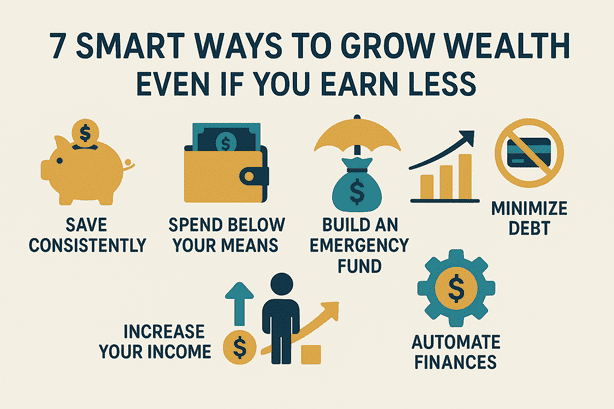

These are the 7 Smart Ways to Grow Wealth Even If You Earn Less

In this article, we will explore the 7 Smart Ways to Grow Wealth Even If You Earn Less, offering practical advice for building a secure financial future.

Start Budgeting and Stick to it

Budgeting is one of the most powerful tools for anyone earning a low income. It enables you to control your spending, identify financial leaks, and allocate funds effectively.

Steps to Build a Budget:

- Record your monthly income from all sources.

- Categorise essential expenses (e.g., rent, groceries, bills).

- Note discretionary expenses (e.g., eating out, subscriptions).

- Identify areas to reduce or eliminate spending.

- Allocate a fixed amount toward savings and investments.

There are many digital tools and apps available for budgeting, such as Walnut, Goodbudget, or even simple spreadsheets.

The widely recommended 50-30-20 budgeting rule suggests allocating:

50% of income to necessities

30% to wants

20% to savings and investments

However, for those with a low income, a more practical variation may be:

70% Essentials

10% Discretionary Spending

20% Savings and Investments

The specific ratio can be adjusted based on individual circumstances. The priority should always be maintaining consistent savings, regardless of income level.

Invest Regularly and Stay Consistent

Starting to invest is important, but what truly moves the needle over time is investing consistently.

Many people delay investing because they feel the amount they can spare is too small to make a difference. But here’s the truth: even modest amounts, invested regularly, can grow into serious wealth over time with the help of compounding.

Let’s look at some numbers to understand how powerful consistent investing can be:

| Monthly Investment | Investment Duration | Expected Annual Return | Corpus at Maturity |

| ₹500 | 10 years | 12% | ₹1.13 lakhs |

| ₹1,000 | 20 years | 12% | ₹9.19 lakhs |

| ₹2,000 | 25 years | 12% | ₹33.27 lakhs |

| ₹5,000 | 30 years | 12% | ₹1.55 crores |

As seen above, a modest SIP of ₹2,000 per month can grow to over ₹33 lakh in 25 years. Increasing the investment to ₹5,000 a month, if and when income allows, can yield more than ₹1.5 crore over three decades.

So even if you’re on a tight budget, don’t underestimate the power of consistency. A little every month, over a long period, can change your financial future.

Build an Emergency Fund Before You Begin Investing

Before focusing on investments or wealth accumulation, it is vital to build a financial safety net in the form of an emergency fund. It safeguards your finances during unexpected situations like health crises, unemployment, or sudden essential expenses.

Emergency Fund Guidelines:

- Set a target of saving enough to manage your core living costs for up to half a year in case of emergencies. Keep the fund in a liquid account, such as a savings account or liquid mutual fund.

- Start small; even ₹1,000–2,000 per month can accumulate meaningfully over time.

An emergency fund ensures that you do not need to liquidate investments or take on debt during unforeseen circumstances.

Eliminate High-Interest Debt

Debt, particularly high-interest consumer debt, can significantly impede your ability to build wealth. Credit card debt, personal loans, and buy-now-pay-later schemes often carry interest rates exceeding 30%, which can quickly spiral out of control.

Debt Elimination Strategy:

- List all existing debts along with their respective interest rates and EMI obligations.

- Prioritise repayment of high-interest loans first.

- Avoid incurring new, unnecessary liabilities.

It is important to differentiate between productive debt (e.g., education or home loans) and consumption-driven debt, the latter of which should be avoided or repaid promptly.

Leverage Tax-Saving Investments

Taxes can erode your investment returns, but smart planning can help you keep more of your money.

Tax-Saving Instruments:

- Public Provident Fund (PPF): Long-term, tax-free returns.

- National Pension Scheme (NPS): Build a retirement corpus with added tax perks.

- Equity-Linked Savings Schemes (ELSS): Tax deductions under Section 80C with growth potential.

You can get the maximum benefits by:

- Invest up to the allowable limits in these instruments.

- Consult a tax advisor or financial advisor like us for personalised strategies.

Increase Your Income

While building wealth on a low income is possible, increasing your income accelerates the process

Start thinking: How can I earn more without quitting my main job?

Side Income Ideas:

- Freelancing: Content writing, design, coding, social media management.

- Online tutoring: Math, English, or even hobby-based teaching.

- Reselling products: From Amazon, Meesho, or local vendors.

- Start a small blog, YouTube channel, or newsletter around a passion.

Start slow, but over time, this can become a powerful income stream that fuels your wealth-building.

Leverage Technology to Manage Finances Efficiently

Technology has made managing your finances simpler and more accessible, even on a low income. By using digital tools, you can stay organized, make informed decisions, and automate your financial growth.

How technology helps:

- Budgeting apps like Walnut, Moneycontrol, etc., help track expenses automatically.

- Investment platforms (Groww, Zerodha, Upstox) allow easy, low-cost investing starting with minimal amounts.

- Expense alerts and reminders ensure bills and EMIs are paid on time to avoid penalties.

- Online courses and financial blogs give you free knowledge to improve financial literacy.

Common Challenges and How to Overcome Them

- Feeling overwhelmed by low income

Focus on what you can control — even ₹ 500 saved monthly adds up. Avoid comparing with others; progress is personal.

- Discipline and consistency

Create habits: automate savings and investments, track spending weekly, and review goals regularly.

- Inflation and rising costs

Invest in instruments that at least beat inflation (like equity mutual funds and PPF). Avoid keeping too much money idle.

Final Thoughts

Growing wealth on a low income isn’t just a possibility, it’s a reality for those who choose consistency over excuses, intention over impulse, and long-term thinking over instant gratification.

You don’t need a big paycheck to build a big future.

All it takes is consistent habits, mindful discipline, and the confidence that you can shape your own financial future.

Start where you are:

- Track your spending.

- Save what you can.

- Invest regularly.

- Learn continuously.

- Stay patient.

The journey may be slow, but every rupee saved and invested is a brick laid on the foundation of your future wealth.

Remember:

It’s not about how much you earn, it’s about how much you keep, grow, and use wisely.

So take that first step today. Your future self will look back and thank you.